Division 296 Tax: What the Election Outcome Means for Your Super

After an uninspiring Federal Election that has produced a Labour majority in the House of Representatives, we can be sur...

.svg)

If you’re dreaming of retirement, you’re not alone. According to the Australian Bureau of Statistics, half a million Australians intend to retire in the next five years.

Have you really thought about what retiring means? You need to consider many factors as you plan your retirement. Two of the most essential factors include how this change will affect your lifestyle and then how those lifestyle changes will affect your spending.

Retirement means no longer earning income from a job. If you’re like many Australians, that means suddenly having to fully rely on whatever nest egg you’ve built by the time you finish work. Due to increasing life expectancies, this money may have to last you for 30 years or more.

To avoid unpleasant surprises and ensure your money lasts, you need to be aware of how much you will need to spend. You can do this by setting a budget.

So what exactly is a retirement budget? Let’s take a look.

When most Australians retire, they’ll get their income from three sources:

Unfortunately, no matter how well they manage their superannuation fund and investments, the money they have at retirement is essentially finite. Most retirees don’t earn any further substantial income, so they must work out how best to make their lump sum last through their retirement years.

For the average person who retires at 55.4, that lump sum may need to last for over 30 years.

While you can’t control how your investments perform, you can control how much you spend. Putting a budget in place, allows you to be much clearer about how long you’ll be able to live the lifestyle you want.

A retirement budget is a plan for how you’ll spend your money once you retire. The specific expenses will vary for each person, but you can break them down into two categories: essential and non-essential expenses.

Essential expenses include costs like:

Non-essential expenses are more individual, but can include spending on:

Your existing expenses are often a good baseline for your retirement budget. If you don’t already keep track of where your money goes, check back over your bank and credit card statements to calculate your current expenses.

Some essential questions to ask yourself when mapping out your retirement budget include:

Considering questions like these will help you work out which expenses you need to include in your retirement plan.

While you may think your spending will automatically reduce later in retirement (e.g. once you’ve upgraded your home and taken your overseas trip), that’s often not the case. Medical expenses often increase, as do your desires to help the next generation.

That’s why we recommend not just focussing your retirement budget on your first few retirement years. Instead, map out what you think your spending may be over your whole retirement.

For help working out a clear retirement budget download our retirement budget worksheet.

When should you plan your retirement budget? Can you just wait until you actually retire?

No! It's far better to look ahead and create your budget in advance. That way, you get a chance to 'put on your training wheels' and test how realistic your plan is before you have to rely on it.

Many people find that their retirement expectations don’t match reality. They may have dreams of travelling, then discover that a world trip just isn’t financially viable. Retiring can be stressful enough as it is and being forced to suddenly shift expectations can make it even more so.

Creating and trialling a retirement budget early means you can stress-test how it works for you. For example, if your budget only allows you to eat out as an occasional treat, but you like dining at your favourite restaurant every week, you probably have some tweaking to do.

Advanced planning also allows you to look strategically at how you want to spend your retirement, and what expenses your choices will entail. Once you know that, you can ask your financial advisor how best to make it happen.

A retirement budget lets you know how long your capital will last, given the choices you want to make. But how do you know what type of lifestyle you can afford?

A superannuation calculator can estimate how much your super will be worth by the time you retire. This gives you an idea of the lifestyle you’ll be able to afford.

The Association of Superannuation Funds of Australia (AFSA) Retirement Standard breaks your choices down into ‘modest’ and ‘comfortable’ retirement lifestyles:

Examples of options in each lifestyle include:

|

Modest retirement |

Comfortable retirement |

|

Takeaway food and a cheap restaurant occasionally |

Regularly dining at restaurants and eating a good range and quality of food |

|

Repairs only with no budget for replacements |

Replacing your kitchen and bathroom over 20 years |

|

Basic private health insurance |

Top-level private health insurance |

|

One leisure activity occasionally, such as going to the cinema |

Having a range of leisure activities |

As of March 2020, AFSA estimates the yearly cost for each lifestyle as:

|

|

Modest retirement |

Comfortable retirement |

||

|

|

Single |

Couple |

Single |

Couple |

|

Total per year |

$28,220 |

$40,719 |

$44,183 |

$62,435 |

AFSA also includes sample detailed budget breakdowns on their website as a starting point for filling out your own retirement budget worksheet.

It’s important to talk through multiple scenarios with your financial advisor and look at how long your money will last with the options you’d like. Can you afford to spend your retirement the way you’ve dreamed? Or will you need to start thinking about compromises?

Assumptions:

At Ulton, we help you to understand the financial consequences of any compromises you make. We help you plan by working through multiple scenarios with you. As a result, you can see the impact of your choices at a glance.

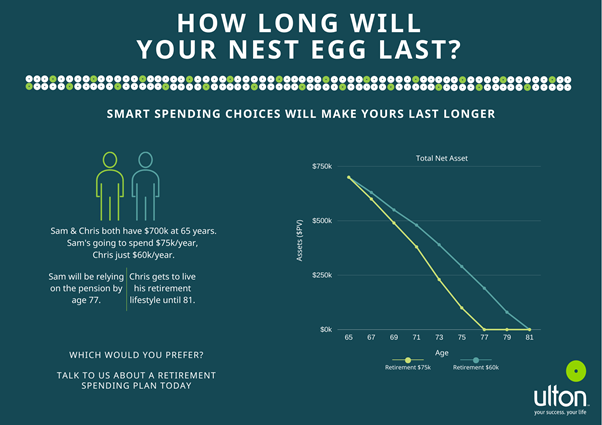

For example, you can see here that if you underestimated your yearly expenses by $15,000, it would cut your spending short by 4 years.

Our scenario modelling makes it easy to quickly see how far your capital will stretch. And we can also show you the impact of any spending decisions, such as:

Seeing how each choice will impact your lifestyle can help you to prioritise what’s most important in your spending plan if necessary.

You’ve worked hard for your money, and you deserve the best retirement you can afford without stressing over every dollar.

Here at Ulton, we help guide you in the lead-up to retirement, and during your transition from working to your new lifestyle. As part of this, we discuss your expectations, then model different scenarios so you can see what will happen based on your choices.

We’re here as your counsel, your silent partner and your most vocal advocate. Our specialist Wealth Management team will help you to make confident retirement decisions and take the stress out of the process.

For help with your retirement options reach out to Ulton's Wealth Management team.

There is no better advertisement campaign that is low cost and also successful at the same time.

After an uninspiring Federal Election that has produced a Labour majority in the House of Representatives, we can be sur...

In life, change is the constant. Our personal circumstances change, unexpected surprises crop up and our priorities shif...

Farmers will be significantly and disproportionately affected if the Division 296 passes in its proposed state, an exper...