Better Targeted Super Concessions (The $3M Cap)

Treasurer Dr Jim Chalmers unveiled the proposed Better Targeted Super Concessions as a new tax on super in February 2023...

.svg)

Payroll Tax is a state tax collected on wages once the applicable threshold has been met.

The current threshold for Queensland is $1,100,000.

If you employ people in other states then you would need to be aware of that states threshold.

In order to assess whether you need to register for payroll tax and have reached the threshold you need to calculate your taxable wages. The following are included in this calculation -:

There are some exemptions, mainly payments to apprentices employed under the Further Education and Training Act 2014 (FET Act) are generally exempt.

Payments to trainees registered under the FET Act are exempt unless before commencing the traineeship, the trainees worked for you for either:

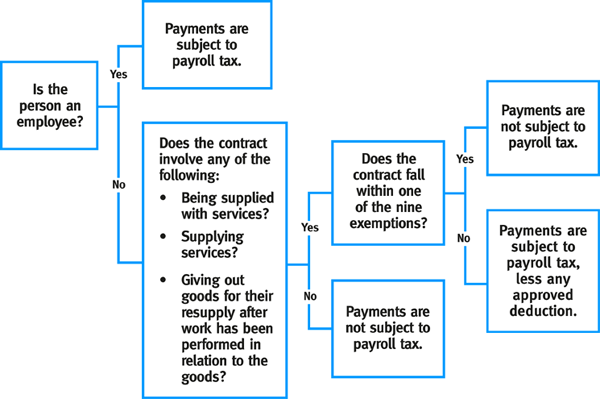

Payroll Tax on Contractor Payments is a main focus at present by the Office of State Revenue, the rules governing this component of the Act are under Division 1A.

An independent contractor is an entity that agrees to produce a specific result for an agreed price. Contractors can include:

In most cases a contractor:

You only need to satisfy one of the following nine exemptions for your contractor payment to be exempt from payroll tax.

Payroll tax can be a very complex matter and a costly one to get wrong. Please contact your Ulton advisor should you need assistance with any business tax issue.

Click here to read more about 'Grouping' Payroll Tax in Queensland

There is no better advertisement campaign that is low cost and also successful at the same time.

Treasurer Dr Jim Chalmers unveiled the proposed Better Targeted Super Concessions as a new tax on super in February 2023...

It has long been the ATO’s practice to treat a trust’s unpaid present entitlements (“UPE”) to a company as a loan for th...

Small businesses with an aggregated turnover of less than $50 million will be able to claim a bonus deduction equal to 2...