The role of financial dashboards in team alignment

There’s no doubt that the advent of financial dashboards has changed the game for business owners. These systems, powere...

.svg)

The ATO has put its foot down, from 1 July 2022, trust distributions made to companies will no longer be allowed to be held under a sub-trust arrangement.

Previously trust income distributions made to companies could be held on either 7 or 10-year sub-trust arrangements. Under these arrangements, interest is required to be paid each year after commencement at the prescribed interest rates. However, the principle of the loan was not required to be repaid until the end of the arrangement.

In TD 2022/D1 the ATO announced that it will withdraw TR2010/3 & PSLA 2010/4 which permitted sub-trust arrangements. Instead, distributions from 1 July 2022 will need to be paid or placed on a Division 7A complying loan agreement for a deemed dividend to not occur.

The division 7A loan (financial accommodation) will occur when the company beneficiary has knowledge of the amount it can demand immediate payment from the trustee but chooses not to. Where the company and the trustee have the same directing mind and will, the company is taken to know the amount it can demand from the trustee at the same time when the trustee knows the amount. The timing of knowledge will be dependent on how the trustee expresses the company’s entitlement. Where a trustee resolves to make a company presently entitled to:

TD 2022/D1 will apply from 1 July 2022, therefore it will apply to present entitlements made to companies on 30 June 2023 or later (as trust income frequently arises at the end of the financial year). For trust income entitlements that occur because of a method that requires calculation at a later time, the loan will not be provided by the company until the 2023-2024 income year. The first yearly minimum repayment of a complying loan is required to be made by 30 June of the year following the income year in which the loan was provided.

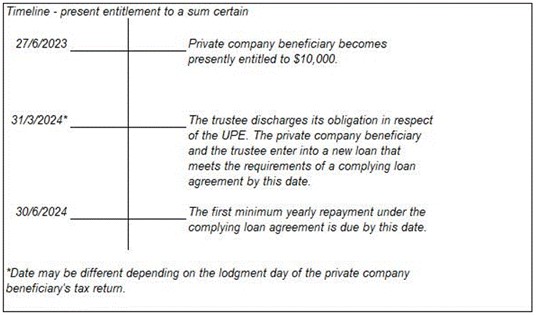

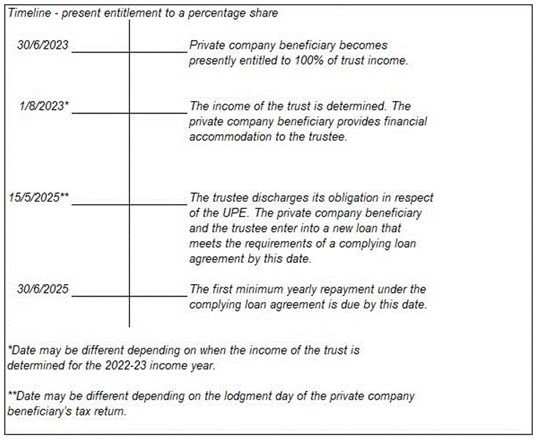

The following timelines illustrate the difference between the complying loan requirements depending on whether the trust entitlement is expressed as a fixed amount, a percentage of trust income or some other part of trust income identified in a calculable manner.

A fixed amount of trust income – 27 June 2023 Trustee resolved to make a company entitled to $10,000 of trust income for the 2022-2023 year

A percentage of trust income – 30 June 2023 Trustee resolved to make a company entitled to 100% of the trust income for the 2022-2023 year

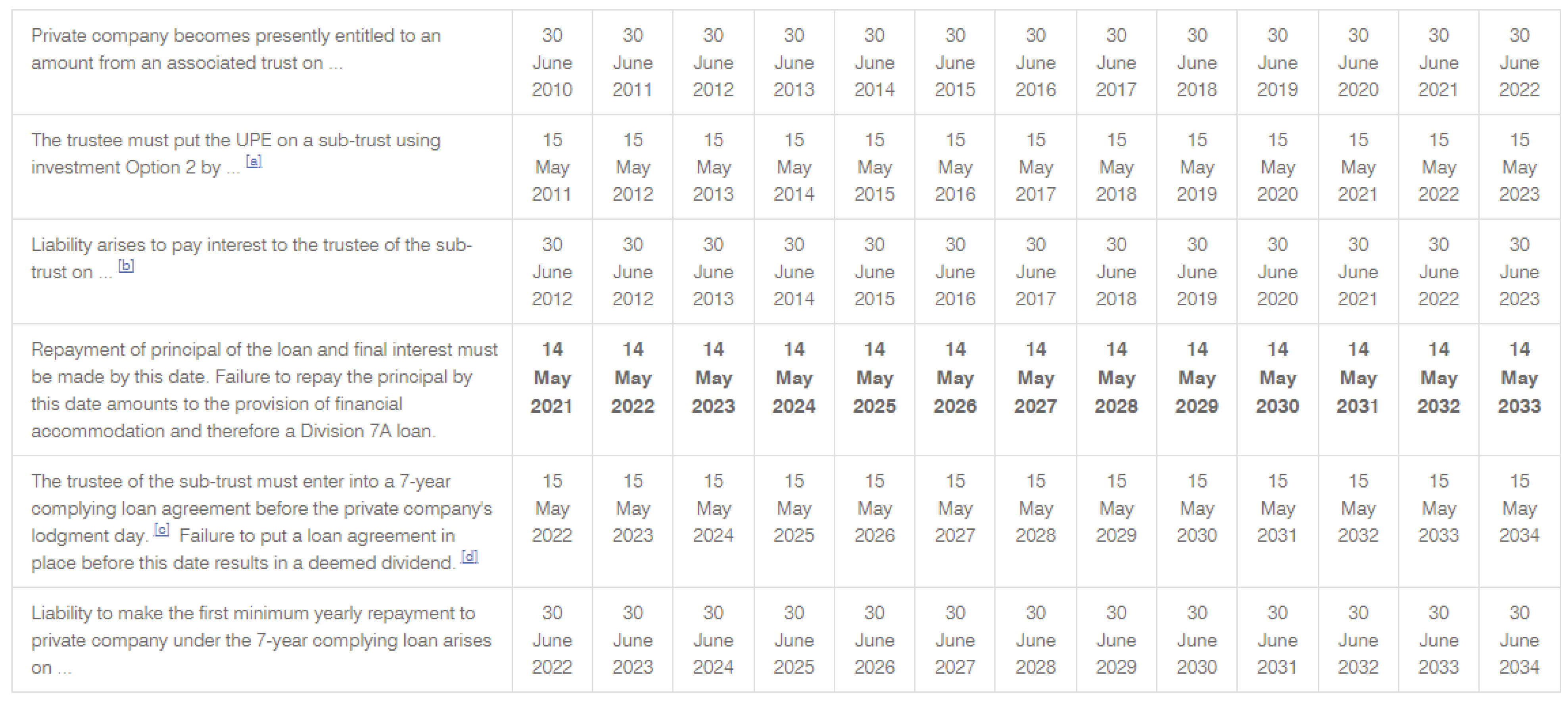

On the 7th June 2022 the ATO also updated their PCG 2017/13, this PCG allows trusts that have not repaid the principle of either a 7-year or 10-year interest-only sub-trust on its maturity to be placed on a Division 7A complying loan prior to the private company’s lodgement day. The update was to extend the arrangement to all sub-trust created up until 1 July 2022 after which the new rules come into effect as discussed above.

If the sub-trust has not been put on a complying loan a deemed dividend will arise at the end of the income year in which the loan matures (to the extent that it remains unpaid).

The following tables outline the key dates that the relevant parties must note where the sub-trust is not repaid by the due date in the relevant income year.

Due to the requirement to now pay principal and interest, this may cause issues for businesses operating through trust structures. If you wish to discuss the implications that these changes may have on your circumstances, please contact your trusted Ulton advisor.

Due to the requirement to now pay principal and interest, this may cause issues for businesses operating through trust structures. If you wish to discuss the implications that these changes may have on your circumstances, please contact your trusted Ulton advisor.

Footnotes

a Date may be different depending on the lodgment day of the main trust’s tax return.

b Date may be different if the main trust has an approved substituted accounting period.

c Date may be different depending on the lodgment day of the private company’s tax return.

d The deemed dividend arises at the end of the income year in which the loan matures and trustee of the sub-trust fails to enter into a complying loan agreement before the private company’s lodgment date.

Source

Australian Taxation Office for the Commonwealth of Australia, Practical Compliance Guideline, PCG 2017/13, Division 7A - PS LA 2010/4 sub-trust arrangements maturing in or after the 2016-17 income year, https://www.ato.gov.au/law/view/document?docid=COG/PCG201713/NAT/ATO/00001

There is no better advertisement campaign that is low cost and also successful at the same time.

There’s no doubt that the advent of financial dashboards has changed the game for business owners. These systems, powere...

Earlier this year, the team published an article discussing the key benefits that flow from external CFO services. We to...

It’s impossible to truly understand your numbers if you’re only looking at them in isolation. A million dollars in sales...