How an external CFO enhances access and opportunity

Earlier this year, the team published an article discussing the key benefits that flow from external CFO services. We to...

.svg)

In response to COVID-19 causing a large shift to the number of employees working from home the Australian Taxation Office (ATO) introduced a shortcut method for claiming additional home running expenses in Practical Compliance Guideline (PCG) 2020/3. However, this guideline only applied for the periods 1 March 2020 to 30 June 2022.

Due to the guideline coming to an end, on the 16 February 2023 the ATO finalised the new PCG 2023/1 for claiming running expenses incurred while working from home.

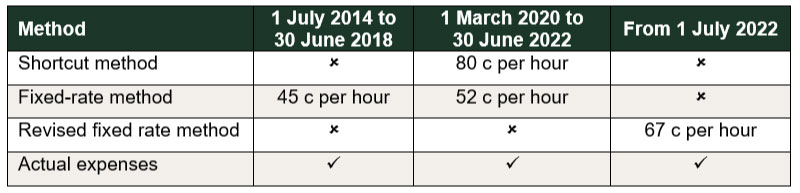

The result of the finalised guidelines to the available methods of claiming home running expenses can be summarised as follows:

The fixed rate method of claiming home office expenses has been available since 1 July 1998.

Shortcut vs Fixed-rate Method vs revised fixed rate method

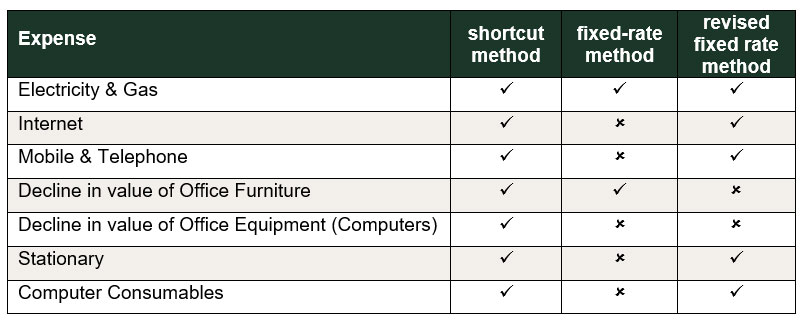

Each method has specified expenses that are included in the hourly rate. Where the method used includes the expense, taxpayers are not able to claim a separate deduction for those expenses.

The expenses included in each method are detailed below:

Additionally, the revised fixed rate method does not require the taxpayer to maintain a dedicated work space unlike the previous fixed-rate method.

The new guideline advises that where a taxpayer has used the revised fixed rate method to calculate their working from home deductions, no compliance resources will be applied to review their deduction where the taxpayer is:

When there are multiple taxpayers in the household each taxpayer is able to utilise the revised fixed rate method where each of the taxpayers meets the above requirements. Each taxpayer is also able to choose which method they will use to calculate their expenses (being either the revised fixed rate method or actual expenses).

We're here to help

Please reach out to our Ulton Tax Advisory Team if you wish to discuss your situation.

Resources

PCG 2023/1 - Claiming a deduction for additional running expenses incurred while working from home - ATO compliance approach

https://www.ato.gov.au/law/view/document?docid=COG/PCG20231/NAT/ATO/00001

PCG 2020/3 - Claiming deductions for additional running expenses incurred whilst working from home due to COVID-19

https://www.ato.gov.au/law/view/document?docid=COG/PCG20203/NAT/ATO/00001&PiT=20211015000001

PS LA 2001/6 - Verification approaches for home office running expenses and electronic device expenses

https://www.ato.gov.au/law/view/document?docid=PSR/PS20016/NAT/ATO/00001

There is no better advertisement campaign that is low cost and also successful at the same time.

Earlier this year, the team published an article discussing the key benefits that flow from external CFO services. We to...

It’s impossible to truly understand your numbers if you’re only looking at them in isolation. A million dollars in sales...

Excess inventory is the stock a business holds beyond what it needs to meet current demand. It’s the unsold goods sittin...