The role of financial dashboards in team alignment

There’s no doubt that the advent of financial dashboards has changed the game for business owners. These systems, powere...

.svg)

A feature of this Budget is its focus on economic recovery by encouraging Australians to spend money and incentivising job creation.

From a taxation perspective this is principally achieved by the following tax measures:

There are other tax measures which will assist business and individuals:

The exemption will only apply to agreements that are entered into because of "family relationships or other personal ties" and will not apply to commercial rental arrangements.

Personal Tax Cuts

In summary from 1 July 2020:

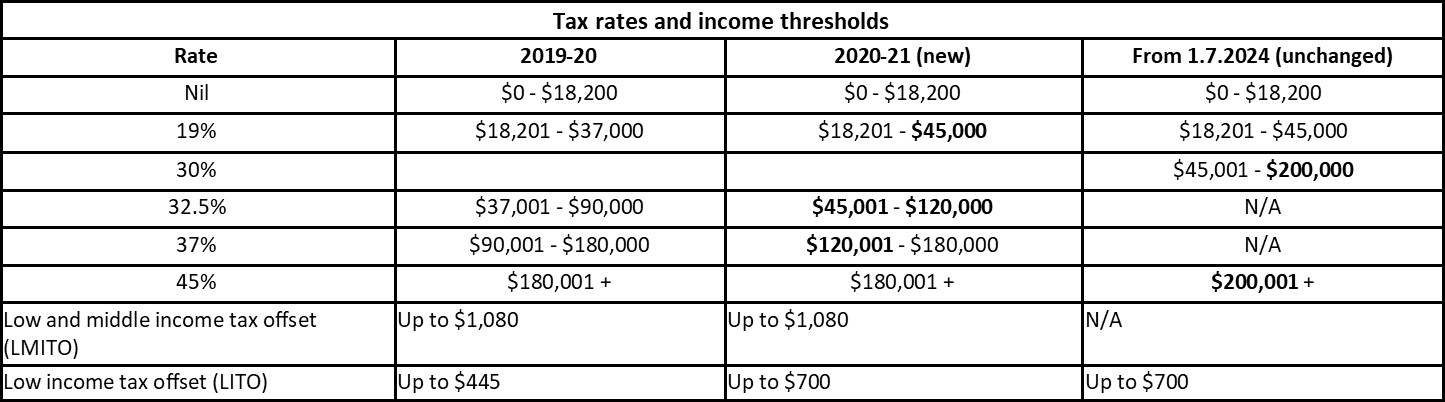

Rates and threshold tables

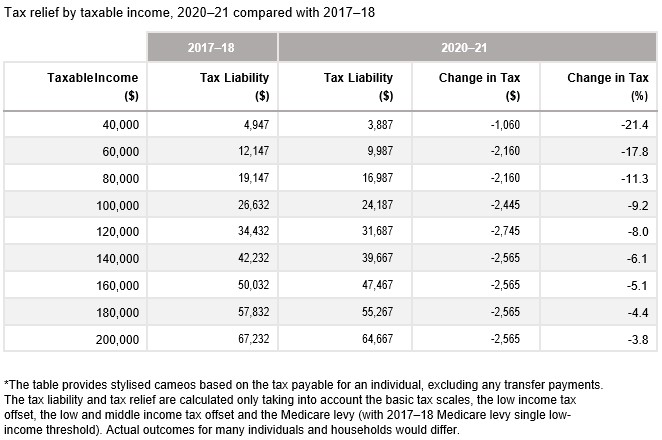

The actual cash impact of the above rate changes are illustrated by this table provided in the budget papers:

The proposed rules provide:

The proposed measures will provide temporary tax relief by allowing eligible corporate entities (that is, entities with a aggregated turnover of less than $5 bn) to elect to carry-back tax revenue losses made in the years ending 30 June 2020 to 2022 to offset tax paid on profits made during the 2019 income year onwards.

There are importantly some limitations in relation to this measure:

• Losses carried back cannot exceed earlier taxed profits;

• The carry-back amount must not generate a franking account deficit; and

• It does not apply to other types of entities – trust, partnership or sole trader.

For corporate entities that elect to apply this measure, they will receive a tax refund in the loss-making year equal to the tax which has been offset by the losses carried back.

The franking account deficit limitation will be a significant impediment to the practical implementation of the measure. It is not unusual for small companies to pay franked dividends to its shareholders during profitable years, first as a return to the shareholders but also to offset Division 7A loan arrangements. In both instances the franking credits generated by tax paid are offset by the franking credits applicable to the franked distributions.

Note that if the corporate entity does elect to use the loss carry back rules, the loss will be able to be carried forward in accordance with the existing loss rules (Division 165 & Division 166 ITAA 1997).

If you have any questions or concerns about the proposals from the Federal budget announcements, please contact your Ulton Advisor to discuss.

Want to read We have broken the full budget down into 6 main categories for usability.

There is no better advertisement campaign that is low cost and also successful at the same time.

There’s no doubt that the advent of financial dashboards has changed the game for business owners. These systems, powere...

Earlier this year, the team published an article discussing the key benefits that flow from external CFO services. We to...

It’s impossible to truly understand your numbers if you’re only looking at them in isolation. A million dollars in sales...