The role of financial dashboards in team alignment

There’s no doubt that the advent of financial dashboards has changed the game for business owners. These systems, powere...

.svg)

The highly anticipated ATO tax ruling on 100A reimbursement agreements was released on the 23rd February 2022 accompanied by a Practice compliance guideline (PCG) and Taxpayer Alert (TA). These releases come hot on the heels of the Guardian case in relation to 100A which the court found in favour of the taxpayer, resulting in 100A not applying. The ATO have disregarded this case in their new publications as it is currently subject to an appeal.

Broadly 100A is an integrity provision that applies when a distribution has been made to a beneficiary with an agreement that another entity will benefit from that distribution. Also, because of the agreement, there is an expectation of a reduction of the tax payable on the trust income due to that beneficiary being liable to pay less tax (even if the purpose is not achieved). When 100A is enacted, the beneficiary will be deemed not presently entitled to the trust income and the trustee will be taxed on the income at the top marginal rate. The tax ruling also states that both of the two (or more) parties of the agreement are not required to have an exact understanding of the nature or extent to the agreement.

An exemption to the application of 100A is available where the agreement was entered into in the course of ordinary family or commercial dealings. The transaction between the family members and their entities must be capable of explanation as achieving normal or regular familial or commercial ends. A dealing is not considered ordinary because it is commonplace. For an arrangement to be considered commercial it must be expected to advance both parties' respective interests and commercial objectives. The tax ruling states that the objective of reducing the collective income tax liabilities to maximise post-tax group wealth, would not of itself satisfy the ordinary dealing exemption.

The taxpayer in Guardian was successful in applying the ordinary family and commercial dealings exemption. A distinction between the outcome of the Guardian case and the new ATO rulings is that the court held the agreement had to be in place at the time of the distributions whereas the rulings state that while the agreement must be in existence prior to the entitlement, actions of the party before or after that time will be relevant in determining the existence. The details of the Guardian case are similar to example 9 in the tax ruling, which the ATO advised 100A would apply, which is detailed below.

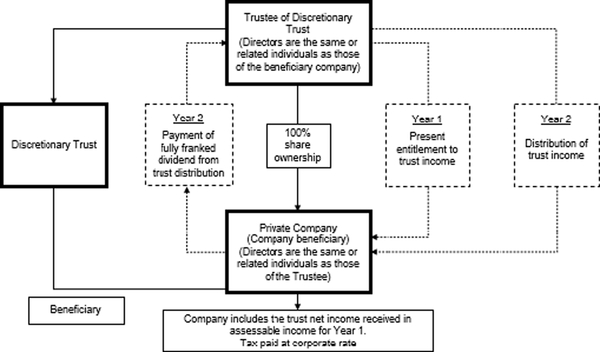

The trustee of a discretionary trust owns the shares in a private company. The company is also a beneficiary of the trust and it undertakes no substantial business activity. The directors of the trustee company and the beneficiary company are the same (or related) individuals.

The trustee makes the company beneficiary presently entitled to all, or some part of, trust income at the end of year 1 and distributes it to the company in year 2 before the company lodges its year 1 income tax return.

The company includes its share of the trust's net income in its assessable income for year 1 and pays tax at the corporate rate.

The company pays a fully franked dividend to the trustee in year 2, sourced from the trust distribution, and the dividend forms part of the trust income and net income in year 2.

The trustee makes the company presently entitled to all, or some part of, the trust income at the end of year 2 (possibly including the franked distribution). The arrangement is repeated.

There is a benefit to the trustee (in that capacity). The agreement provides for the payment of income from the trustee to the company on the understanding (inferred from the repetition in each income year and their common control) that the company would pay a dividend to the trustee of a corresponding amount (less the tax paid).

Absent evidence to the contrary, the concerted steps taken by the trustee and company indicate contrivance. The arrangement appears to be designed to achieve a reduction in tax that would otherwise be payable had the trustee simply accumulated the income. The arrangement is unlikely to be considered to have been entered into in the course of ordinary dealing. The ownership structure and, particularly, the perpetual circulation of funds, do not appear to serve ordinary commercial purposes.

This washing machine arrangement is disliked by the ATO, even with the Guardian case prevailing at this point in time. In the above example, the ATO makes the point that only some part of trust distribution needs to be distributed to the company, which is what occurred in the forementioned case.

This washing machine arrangement is disliked by the ATO, even with the Guardian case prevailing at this point in time. In the above example, the ATO makes the point that only some part of trust distribution needs to be distributed to the company, which is what occurred in the forementioned case.

The below is an example from the ruling which the ATO confirms would satisfy the exclusion for Ordinary Family dealings

From time to time, the trustee of the Davidson Family Trust makes John, who is a family member, presently entitled to a share of trust income. John's entitlement is determined so his taxable income will not exceed certain marginal tax rate thresholds. John is a full-time student and does not have income from other sources. In a particular year, funds underlying the present entitlement are set aside to be held by the trustee upon a separate trust for the sole benefit of John, who has indicated he may be unlikely to call for his entitlements until such time as he purchases a home or makes a similar investment. Nonetheless, John is at liberty to call for his trust entitlements at any time.

John's tax-free threshold reduces the overall tax on the trust net income. However, in the absence of additional factors, the arrangement would likely be entered into in the course of ordinary dealing.

A different outcome may arise if, for example, instead of setting funds aside for John upon a separate trust, the trustee:

The above example shows that although there is a component of tax-saving 100A is not triggered as:

The PCG released by the ATO details to what degree an arrangement has a risk of 100A applying. Where the arrangement falls with the prescribed risk zones will dictate how the ATO will dedicate their compliance resources. The zones and compliance approach are detailed in the below table.

| Risk Zone | Compliance Approach | |

| Low | White | For arrangements entered into in income years ending before 1 July 2014. ATO will generally not dedicate compliance resources |

| Low | Green | ATO will not dedicate compliance resources |

| Medium | Blue | May be subject to review by the ATO but are less likely to attract attention |

| High | Red | ATO will conduct further analysis of the facts and circumstances of the arrangement. |

The TA provides advice that the ATO is currently reviewing trust arrangements where parents are enjoying the economic benefit of trust income appointed to their children who are over the age of 18. Where the parents are the controllers of the trust and trust income is appointed to the children, the ATO is concerned where:

The ATO did provide an example where the TA will not apply to as the expenses are legitimate.

The Green Trust's beneficiaries include the members of the Green Family. Mary Green is the sole trustee of the Green Trust. Mary has an adult child, Genevieve (aged 19), who lives with her grandmother in order to be close to the university she attends.

It is agreed between Mary and Genevieve that Genevieve's tuition fees of $20,000 will not have to be met by Genevieve but that they will be paid out of her trust entitlement. It is agreed between Genevieve and her grandmother that the grandmother will be paid board of $10,000 a year.

During the 2020-21 income year, the Green Trust derives income of $300,000 (the trust's net income is also $300,000).

On 30 June 2021, Mary as the trustee of the Green Trust resolves to make Genevieve presently entitled to $40,000 of the trust income and make Mary entitled to the remaining $260,000.

$20,000 of the $40,000 that Genevieve is presently entitled to is paid to Mary, who has previously met the tuition fees of $20,000 as they fell due. $10,000 of that $40,000 is paid directly to the grandmother. The remaining $10,000 is paid to Genevieve, some of which is used to meet her tax obligations on the $40,000.

Although $30,000 of the $40,000 is not received directly by Genevieve, and might appear to be within the scope of this Alert, it is important that the $30,000 is applied to repay loans for legitimate expenses that might ordinarily be borne by an adult child and were temporarily met on Genevieve's behalf (being tuition fees and arm's length board). The remaining $10,000 was actually received by Genevieve. Accordingly, the concerns raised in this Alert do not arise in arrangements of this type.

If you would like to discuss these matters further please contact your trusted Ulton advisor.

Source

TR 2022/D1 Income tax: section 100A reimbursement agreements - https://www.ato.gov.au/law/view/view.htm?docid=%22DTR%2FTR2022D1%2FNAT%2FATO%2F00001%22#H121

PCG 2022/D1 Section 100A reimbursement agreements - ATO compliance approach - https://www.ato.gov.au/law/view/view.htm?docid=%22DPC%2FPCG2022D1%2FNAT%2FATO%2F00001%22

TA 2022/1 Parents benefitting from the trust entitlements of their children over 18 years of age - https://www.ato.gov.au/law/view/view.htm?docid=%22TPA%2FTA20221%2FNAT%2FATO%2F00001%22

Guardian AIT Pty Ltd ATF Australian Investment Trust v Commissioner of Taxation [2021] FCA 1619 (21 December 2021) - http://www.austlii.edu.au/cgi-bin/viewdoc/au/cases/cth/FCA/2021/1619.html?context=1;query=guardian%20ait%20pty%20ltd%20atf%20australian%20investments%20trust;mask_path=

There is no better advertisement campaign that is low cost and also successful at the same time.

There’s no doubt that the advent of financial dashboards has changed the game for business owners. These systems, powere...

Earlier this year, the team published an article discussing the key benefits that flow from external CFO services. We to...

It’s impossible to truly understand your numbers if you’re only looking at them in isolation. A million dollars in sales...